Faarea Masud

Business reporter, BBC News

House prices fell in April as buyers faced paying thousands of pounds more in stamp duty, according to new figures from Nationwide.

Prices were down 0.6% month-on-month, the building society said.

The slowdown in the market was expected due to changes to stamp duty thresholds kicking in on 1 April.

Annual house price growth also slowed, but homes remain 3.4% more expensive than they were a year ago, with the average price now at £270,752.

Robert Gardener, Nationwide's chief economist, said there was a "significant jump" in transactions in March, with buyers bringing forward purchases to avoid the additional tax charges.

"The market is likely to remain a little soft in the coming months," he said.

But Mr Gardner added buying was likely to pick up as over summer due to earnings rising and the expectation of further cuts to interest rates.

In her October Budget, Chancellor Rachel Reeves announced that the government had decided to lower stamp duty thresholds in England and Northern Ireland.

The changes, which came into effect in April, means house buyers now pay the tax on properties over £125,000, instead of over £250,000, as was the case previously.

First-time buyers will also now have to pay stamp duty on homes costing more than £300,000, whereas before the April change, they did not have to pay the charge unless the property was above £425,000.

Nationwide's house price data is based on its own mortgage lending, which does not include buyers who purchase homes with cash, or buy-to-let deals. Cash buyers account for about a third of housing sales.

April's drop in house prices was the biggest monthly fall since August 2023, according to UK economist Ashley Webb from Capital Economics.

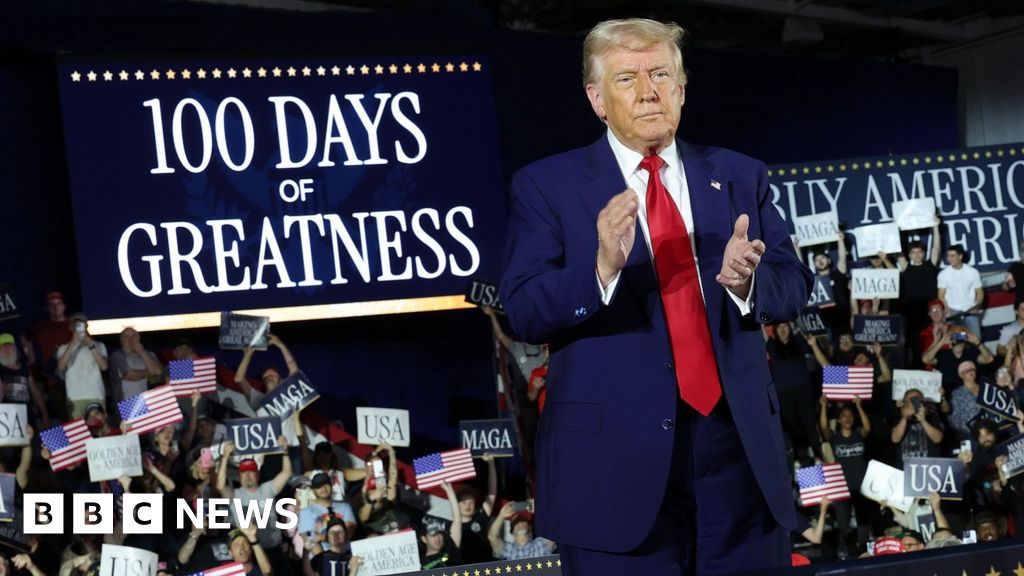

He said that the easing of mortgage rates would help boost housing demand in the coming months, offsetting any tightening in spending as a result of higher prices potentially caused by US president Donald Trump's trade tariffs.

Mr Webb added that house prices are predicted to rise by 3.5% this year, and 4.5% in 2026.

A mini price war has broken out between mortgage providers, although many of the lowest-rate deals still require borrowers to provide a hefty deposit.

All major UK lenders are now offering fixed mortgage deals with an interest rate of less than 4%, but brokers say further cuts are not guaranteed.

Expectations are growing that the Bank of England could cut interest rates three more times this year because of the global fallout from US trade tariffs.

"With the anticipation of further rate cuts and mortgage provider competition, we expect to see the market accelerate through the gears over the remainder of the year," said Jean Jameson, from estate agent Foxtons.

3 hours ago

5

3 hours ago

5