Tom Gerken

Technology reporter

Getty Images

Getty Images

NatWest has apologised after customers were left unable to use its mobile banking app in the UK, preventing some from accessing their bank accounts.

More than 3,000 people have reported problems on outage-checking site Downdetector since the issues first emerged at 0910 GMT.

The firm said on its service status website that its online banking service was still working normally - though this has been disputed by some customers. Card payments are unaffected.

"We are aware that customers are experiencing difficulties accessing the NatWest mobile banking app this morning," a NatWest spokesperson told the BBC.

"We're really sorry about this and working to fix it as quickly as possible."

BBC/NatWest

BBC/NatWest

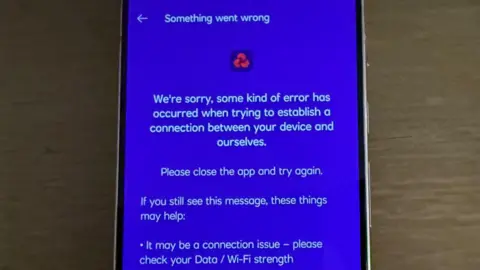

People saw this message when trying to use online banking on Friday

Customers have taken to social media to complain about the impact the IT failure is having on them.

One person said they had to "put back my shopping because of it", while another said they were "waiting to go shopping" but couldn't transfer money to do so.

NatWest has advised customers on social media that it has "no timeframe" for a fix, but said its team is "working hard" to resolve it.

Customers are being advised to access their accounts in other ways if they can - such as through online banking.

However, some people have reported problems with NatWest's online service too, with one sharing an error message which they said was displayed when they tried to make a payment.

Others have expressed frustration with the bank's response, with one saying it was "disgraceful" there was no timeframe, while another called it "very poor service".

"What I don't get is the bank closes loads of branches 'to save money' and forcing people to rely on the app and online banking... but clearly hasn't invested in a system that works properly," one angry customer said.

A recurring problem

This is the latest in a long line of banking outages.

In May, a number of major banks disclosed that 1.2m people were affected by them in the UK in 2024.

According to a report in March, nine major banks and building societies have had around 803 hours - the equivalent of 33 days - of tech outages since 2023.

Inconvenient for customers, outages come at a cost to the banks, too.

The Commons Treasury Committee found Barclays could face compensation payments of £12.5m over outages since 2023.

Over the same period, Natwest has paid £348,000, HSBC has paid £232,697, and Lloyds has paid £160,000.

Other banks have paid smaller sums.

12 hours ago

7

12 hours ago

7