Kevin PeacheyCost of living correspondent

Getty Images

Getty Images

The Bank of England has cut interest rates from 4% to 3.75%, the lowest level since February 2023.

Analysts are divided about whether further cuts will follow in 2026.

Interest rates affect mortgage, credit card and savings rates for millions of people.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England's base rate is what it charges other banks and building societies to borrow money, which influences what they charge their own customers for mortgages as well as the interest rate they pay on savings.

The Bank moves interest rates up and down in order to keep UK inflation - the rate at which prices are increasing - at or near 2%.

When inflation is above that target, the Bank can decide to put rates up. The idea is that this encourages people to spend less, reducing demand for goods and services and limiting price rises.

How will the interest rate cut affect mortgages, loans and savings rates?

Mortgages

Just under a third of households have a mortgage, according to the government's English Housing Survey.

About 500,000 homeowners have a mortgage that "tracks" the Bank of England's rate. A 0.25 percentage point cut is likely to mean a reduction of £29 in the monthly repayments for the average outstanding loan.

For the additional 500,000 homeowners on standard variable (SVR) rates - assuming their lender passed on the benchmark rate cut - there would typically be a £14 a month fall in monthly payments for the average outstanding loan.

But the vast majority of mortgage customers have fixed-rate deals. While their monthly payments aren't immediately affected by a rate change, future deals are.

Mortgage rates have been falling recently, partly owing to the expectation the Bank would cut rates in December.

As of 18 December, the average two-year fixed residential mortgage rate was 4.82%, according to financial information company Moneyfacts. A five-year rate was 4.90%.

The average two-year tracker rate was 4.66%.

About 800,000 fixed-rate mortgages with an interest rate of 3% or below are expected to expire every year, on average, until the end of 2027. Borrowing costs for customers coming off those deals are expected to rise sharply.

You can see how your mortgage may be affected by future interest rate changes by using our calculator:

Getty Images

Getty Images

Savings

The Bank base rate also affects how much savers earn on their money.

A falling base rate is likely to mean a reduction in the returns offered to savers by banks and building societies.

The current average rate for an easy access savings account is 2.55%, according to Moneyfacts.

Any further cut in rates could particularly affect those who rely on the interest from their savings to top up their income.

Will interest rates fall further?

Most analysts had expected the December cut, but the vote among members of the nine-member monetary policy committee (MPC) was divided. Five were in favour of a cut.

The Bank said rates were likely to continue dropping in the future, but warned decisions on further cuts in 2026 would be contested.

"We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call," said the Bank's governor Andrew Bailey.

The latest inflation data for November, published the day before the MPC meeting, showed a larger than expected drop to 3.2%.

Mr Bailey has also repeatedly warned about the unpredictable impact of US tariffs, and uncertainty around the world.

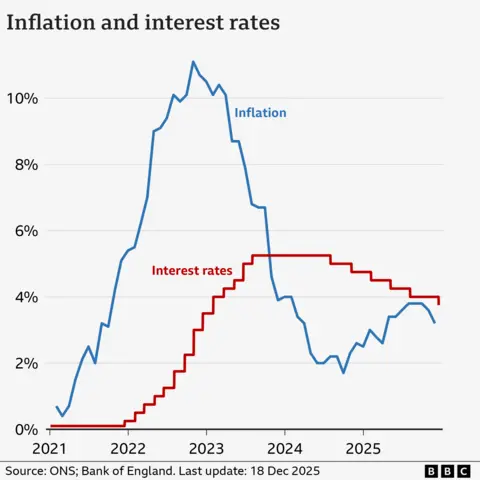

How have interest rates and inflation changed?

The Bank of England's base rate reached a recent high of 5.25% in 2023. It remained at that level until August 2024, when the Bank started cutting.

Five cuts brought rates down to 4%, before the Bank held rates at its meetings in September and November 2025 before the December cut.

The main inflation measure, CPI, has dropped significantly since the high of 11.1% recorded in October 2022.

The 3.2% figure recorded for the year to November 2025 was down from the 3.6% rate recorded in October.

That means prices are still rising, but by less than seen in the summer.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 - the group representing the world's seven largest so-called "advanced" economies.

In June 2024, the European Central Bank (ECB) started to cut its main interest rate for the eurozone from an all-time high of 4%.

At its meeting in June 2025 the ECB cut rates by 0.25 percentage points to 2% where they have remained.

The US central bank - the Federal Reserve - has cut interest rates three times since September 2025, taking them to the current range of 3.5% to 3.75%, the lowest since 2022.

President Trump had repeatedly attacked the Fed for not cutting earlier.

1 month ago

38

1 month ago

38